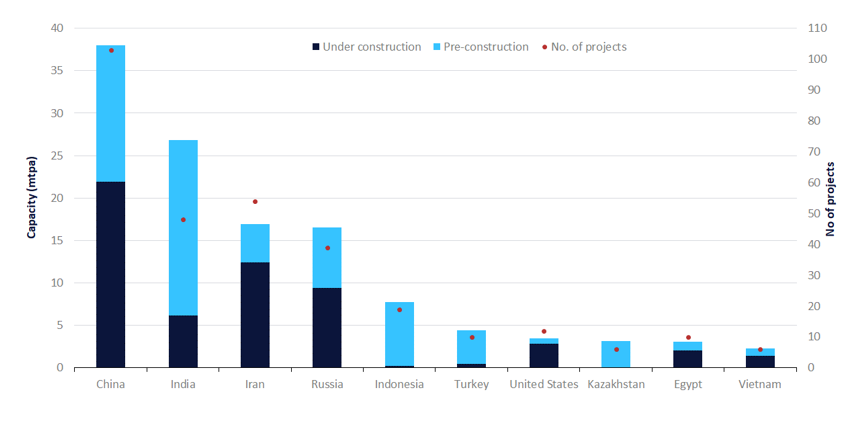

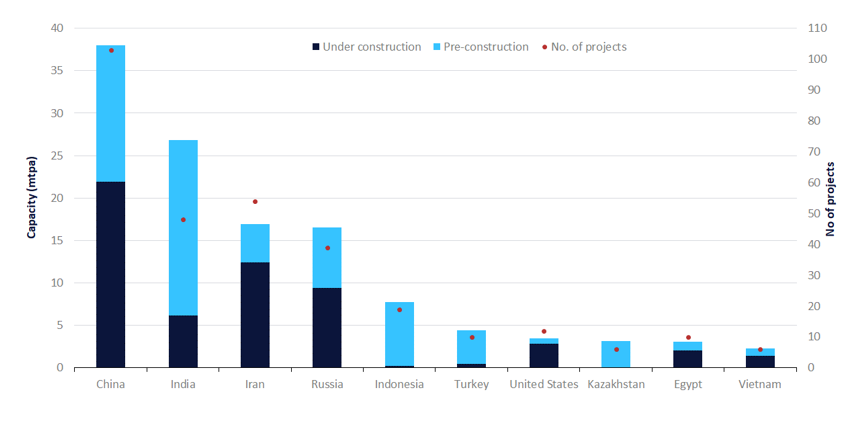

Asian countries to lead global polyolefins capacity additions by 2030

Within Asia, China and India are expected to contribute more than 80% of regional capacity additions.

Within Asia, China and India are expected to contribute more than 80% of regional capacity additions.

British energy giant bp has reduced its leadership team from 11 to ten members and made a number of new appointments.

The oil & gas industry continues to be a hotbed of patent innovation. Activity is driven by the need for...

US increases royalty rates for companies drilling on public lands

‘Sheer scale of the challenge’ the biggest barrier to net zero in APAC

Venezuela’s former oil minister arrested for money laundering

How “energy-hungry AI” is straining grids and spreading climate disinfo