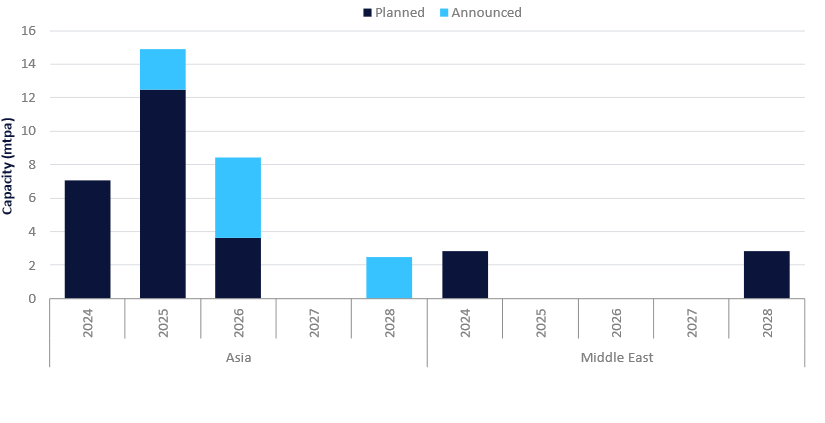

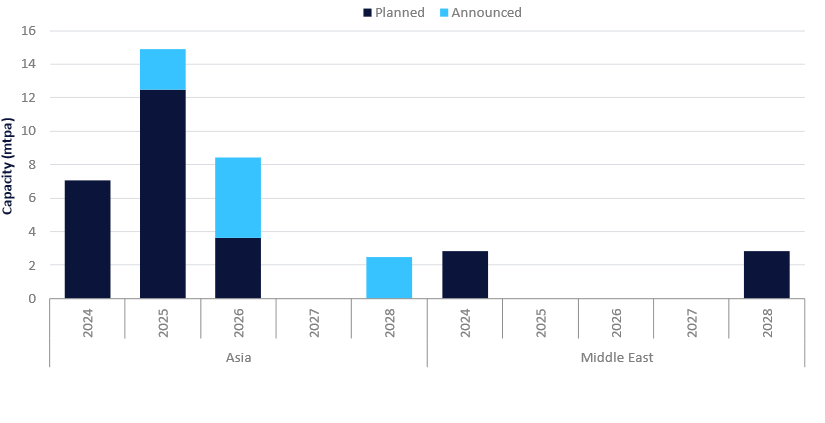

Asia to dominate global PTA capacity additions by 2028

Within Asia, entire PTA capacity additions are from upcoming projects in India and China.

Within Asia, entire PTA capacity additions are from upcoming projects in India and China.

The Biden administration has raised royalty rates on oil drilling from 12.5% to 16.67%, marking the first increase in more than 100 years.

The oil & gas industry continues to be a hotbed of patent innovation. Activity is driven by the need for...

‘Sheer scale of the challenge’ the biggest barrier to net zero in APAC

Venezuela’s former oil minister arrested for money laundering

How “energy-hungry AI” is straining grids and spreading climate disinfo

World-first connectivity: Key announcements from MWC24